Much hype regarding Crowdfunding has hit the internet recently, given new rules (effective May 16, 2016) adopted as part of Title III of the Jumpstart Our Business Startups (JOBS) Act, also known as Regulation Crowdfunding. The purpose of this article is to provide some information on Crowdfunding in the US and what the new regulations mean to investors and business owners.

What is Crowdfunding?

Crowdfunding is a term that describes fundraising via the internet, and from a large number of individuals. Companies like Kickstarter and IndieGoGo have been in this space for years, and there are many new Crowdfunding platforms that now offer Investments in many different types of projects and ventures, from technology to the arts to real estate. Understanding the different types of Crowdfunding could help you understand if an investment in a Crowdfunding venture makes sense for you.

With the new regulations, Congress has worked to provide some guidelines on this evolving investment topic. Given that businesses can use Crowdfunding to raise funds in exchange for an interest in company ownership, this clearly lives within the realm of Securities and Exchange Commission (SEC) purview. Title III offers expanded leniency to an opaque and fairly new space, and it establishes a set of parameters that are intended to help small businesses raise funds from a group of individuals while at the same time protecting investors.

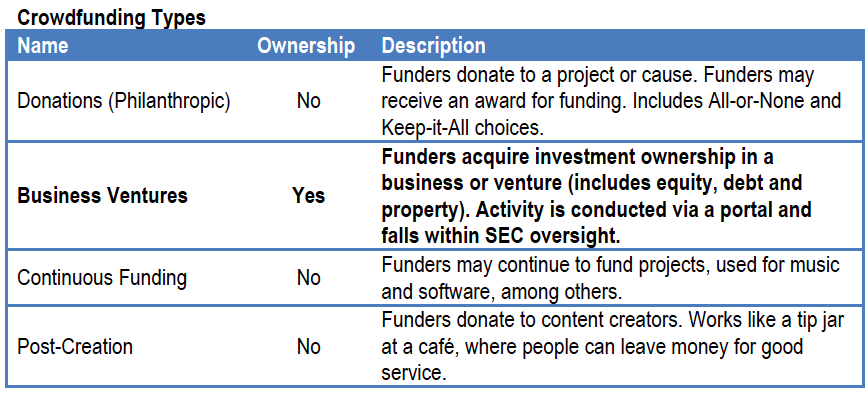

Crowdfunding Models fall into two categories; those that need to comply with SEC regulations, and those that don’t. The table below includes information concerning different types of Crowdfunding. Business ventures, which fall within the SEC purview, are the main focus of this article.

What does it mean to me, the Investor?

As an investor looking to get involved in Crowdfunding, the new regulations mean a larger number of new investment opportunities to choose from. For example, an investor that has traditionally put money in stocks and bonds may now have the ability to diversify their portfolio by investing in small startups and real estate ventures that were previously only accessible by more wealthy, accredited investors.

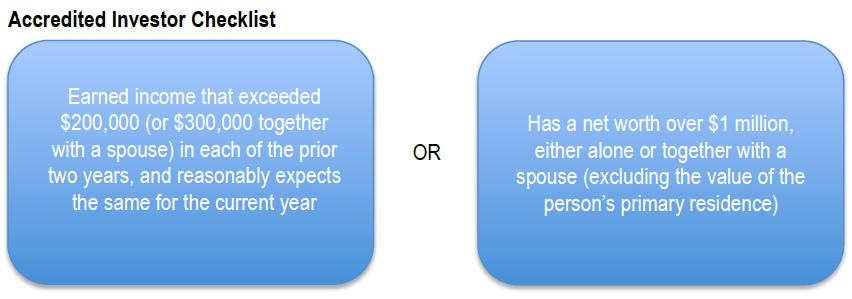

In terms of existing SEC governance, Regulation A+ (Reg A+) and Regulation D (Reg D) registration exemptions offer fundraisers alternate fundraising opportunities. The Reg A+ exemption allows smaller companies to offer and sell up to $50 million of securities in a 12-month period from accredited and non-accredited investors. The Reg D exemption allows companies to target accredited investors for their fundraising activities without the need for full registration.

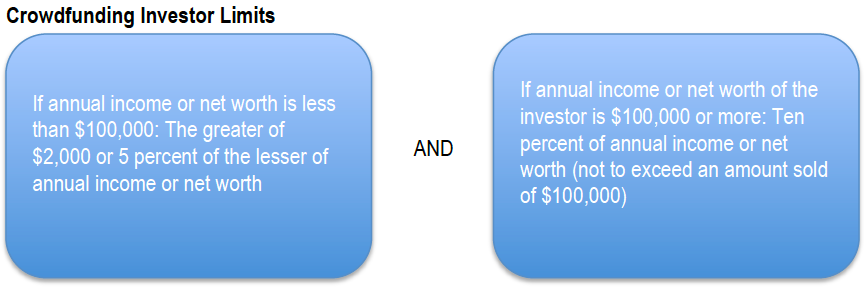

Regulation Crowdfunding lowers the bar in terms of these investor capital hurdles and opens the door to non-accredited individuals that want to invest in smaller business opportunities. That’s great news, but there are limitations on how much one may invest. Individual investments in all Crowdfunding issuers in a 12-month period are limited to the following two investment caps.

What does it mean to me, the business owner/Crowdfund issuer?

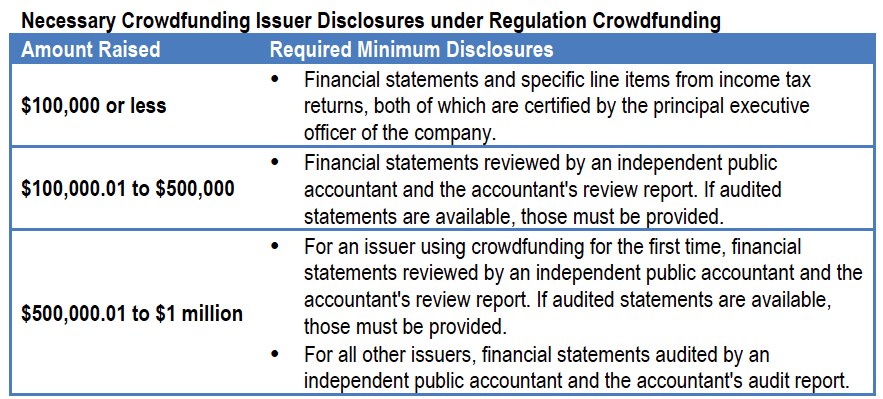

For someone raising cash for a new venture or growth opportunity, this regulation opens up another source for fundraising activity. However, the new regulations have also provided Crowdfund issuer limits.

One fundamental limit of Regulation Crowdfunding is that the amount raised by Crowdfunders may not exceed $1 million per year. For some businesses, this could be a marginal amount of startup cash. Also, the cost of registration and compliance may quickly outweigh any benefits associated with Regulation Crowdfunding.

In this case, a Reg A+ or Reg D offering may better suit a business owner. Furthermore, there are other considerations, such as keeping up with disclosures, filings and regulation compliance. The Reg A+ and Reg D exemption offerings may have some distinct advantages over full registration and registration required by Regulation Crowdfunding. Also, Reg A+ and Reg D allow a business to raise more capital for larger projects, which can more easily absorb the costs of legal, accounting, platform and other expenses associated with the Crowdfunding process.

Now, working through the math of individual investment limits set forth by the new regulation, this means by definition each Crowdfund that raises the $1 million annual limit would have at least 10 investors each contributing $100,000. Alternatively, a company may raise smaller amounts from more investors. For example, a Crowdfund could comprise 400 investors each with $50,000 in annual income and net worth of $100,000. The idea is that these new investors will now come in many shapes and sizes.

It’s important to highlight these numbers, given that keeping track of all the contributions made by these investors can become a daunting task. Luckily for Crowdfunders, the new regulation also stipulates that Crowdfunding activities must be conducted through a funding portal or registered broker-dealer. This requirement is also meant to combat fraud, but it comes at a costs. Platform and compliance fees, as published by Venturebeat, can range from 7% to 39%, depending on the amount of money raised.

What does the future hold for Crowdfunding?

The industry is fairly new, and there are many possible applications. Opening up the funding spigots will provide more opportunities for investment. For example, mortgage funding is now being raised via Crowdfunding, replacing traditional mortgage bank lending. High yielding commercial buildings can now help to diversify the investments in an individual’s personal portfolio. Could Crowdfunding overtake peer-to-peer lending? What role, if any, will the traditional banking community have with Crowdfunding?

Looking forward, will retirement accounts (i.e., 401Ks) offer consumers opportunities to invest in Crowdfunding ventures, such as real estate investments and startups? The retirement accounts industry has traditionally allowed investors to access investments via equity and fixed income mutual funds. The Investment Company Institute reported total US retirement assets were $24.0 trillion as of December 31, 2015, with almost $5 trillion in 401K investments. These potential Crowdfunders present a huge opportunity to bring new assets to the business startup masses.

Like with all investments, one should do their research to fully understand the risks of Crowdfund investing. Crowdfunding seems to offer investors with diversification, and one should weigh the risks (such as lack of liquidity) to determine if these investments are appropriate for them. Those looking to raise cash should also investigate all the options available.

Contributions by: Ilan A. Nieuchowicz, Carlton Fields, Attorney, Shareholder and Member of the Firm’s Crowdfunding Taskforce. For more information, visit Ilan’s biography.

Image borrowed from ebuyer.com.

Some useful articles on Crowdfunding

- A Kickstart to Business: Florida Joins Other States in Passing Intrastate Crowdfunding Exemption

- Comparison of Crowdfunding Services

- Crowdfunding and the JOBS Act: What Investors Should Know

- FINRA Offers What Investors Should Know about Crowdfunding

- Florida Embraces Innovation, Entrepreneurship, and Crowdfunding

- How Crowdfunding Has Changed Real Estate Investing

- Investor Bulletin: Crowdfunding for Investors

- It might cost you $39K to crowdfund $100K under the SEC’s new rules

- Looking for yield? Investors turn to real estate crowdfunding

- RealtyMogul.com Becomes First US Commercial Real Estate Crowdfunding Platform to Fully Fund $200 Million

- SEC Adopts Rules to Facilitate Smaller Companies’ Access to Capital (Reg A+)SEC Adopts Rules to Permit Crowdfunding – Proposes Amendments to Existing Rules to Facilitate Intrastate and Regional Securities Offerings

- Why Equity Crowdfunding Could Be Dangerous for Investors and Entrepreneurs

- 5 Crowdfunding Trends You Need to Know About