Costa Rica is well known for its agricultural products. Contrary to this belief, the country has much more to offer than its agricultural know how. Over the years, the Costa Rican economy has been morphing into a more diversified economy, offering medical devices and other technology.

Agriculture accounted for about 16% of Costa Rica’s GDP in 1990. Interestingly, agriculture made up about only 5% of GDP in 2018 (World Bank).

Taking a look at Costa Rica’s technology industry growth, we can see what is making up for this shift. According to a recent study by Finnovista, Costa Rica’s FinTech sector has expanded by 400% since 2017.

The FinTech Opportunity

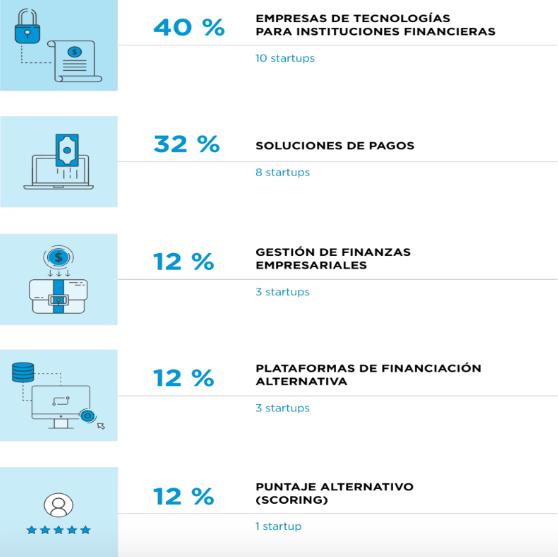

The majority of Costa Rican banks (state-owned) are slow to develop and implement the latest technologies. This presents the biggest opportunity to offer FinTech services in Costa Rica. The industry is in its infancy; there are only 25 companies currently in the space according to a study by Finnovista published in June 2019.

An Economic Struggle

True, the country is going through a rough patch at the moment. The government is in the middle of implementing tax reform (Ley 9635), including a value added tax (VAT). However, these are attempts by the administration to produce revenue in order to tackle its growing debt issues.

Actually, the change in tax policy seems positive for future growth, and the IMF suggests reforms including:

- 1) Enhancing of the quality and efficiency of the education system and

- 2) The promotion of innovation, technological diffusion and integration into the global value chain.

Among the many sectors that could benefit, this bodes well for Costa Rica’s burgeoning FinTech industry.

Light at the End of the Tunnel

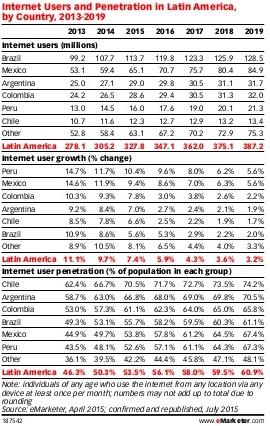

Internet industry expert eMarketer sees continued growth for Latin America’s Internet User Penetration (as a percent of the population). They see this number rising to over 60% in 2019, up considerably from the 43% the region experienced in 2013. This supportive trend should pave the way for the industry. The trend is testament to the growing comfort level of consumers using technology for everyday tasks, like mobile payments.