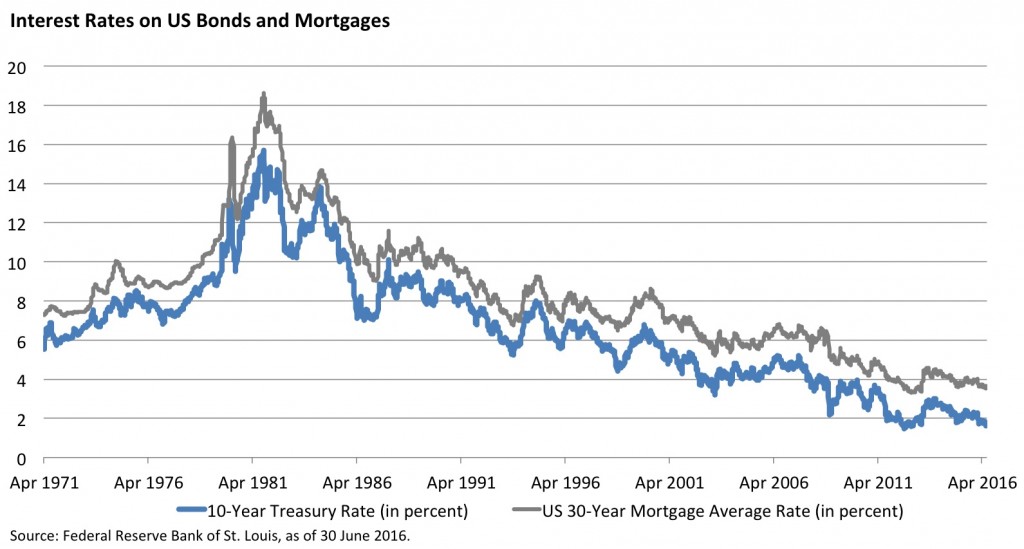

In July of 2012, interest rates on the US 10-year Treasury were at their lowest levels ever. Also, the rate on the average US 30-year Mortgage stood slightly below 3.5%. At the time, it seemed like a great time to try to lock in low rates as rates were destined to take off. If you’ve read my previous posts on this topic, it may seem a little like the story of the boy who cried wolf. Rates were on their way up, and the big, bad wolf would usher in higher rates. Those with floating loans may have been exposed to higher interest rates and would feel the pinch of higher debt service payments. In hindsight, however, the past becomes clearer.

Three years and one rate hike later, it now seems like the Fed is in no rush to raise interest rates (see video below). In fact, the market is pricing in close to even odds that the next Fed interest rate move will be up or down. Curious how an external event (Brexit) can change the trajectory of where rates are headed, but we’ll leave that discussion to the experts.

How Brexit Has Changed the Odds for a Fed Rate Hike (Bloomberg Video)

Below is a chart of the interest rates of the 10-year Treasury bond and the average US 30-year Mortgage. Since rates hit a peak in the 80s, interest rates have been trending lower. When will this trend end?

Crying Wolf

Borrowers could take advantage of these historically low interest rates environment by locking in today’so relatively low rates. Or will rates move even lower, proving this to be just another case of the boy crying wolf?

Wolf image borrowed from speakaboos.com.